MIRR Calculation Help

MIRR is a short form for modified internal rate of return. It denotes a Capital Budgeting technique that is used to assess investment returns, compare different investments and the rate of re-investment.

As the name suggests, this investment measurement technique is derived from the normal internal rate of return but it has been modified to improve efficiency.

In the past, investors and accounting professionals have associated IRR with confusion and ambiguity. For instance, IRR assumes that business cash flows are reinvested at the same fraction at which they were made.

As for MIRR, it provides that net cash inflows ought to be reinvested at a specified cost of capital. The evaluation of variance between investment rate and re-investment rate makes MIRR an attractive financial measure.

Looking for someone to do my Finance homework for me?

Do you need need help with Finance Homework? We are here to help you improve your grades in school and increase the chances of succeeding in life. We understand that not everybody is good in class and that is why you need to consider hiring and expert to help you get better grades for your assignments.

Advantages and Disadvantages of MIRR

By calculating MIRR, individuals successfully eliminate limitations associated with IRR. For example, multiple IRR outcomes bring confusion when cash flows are uneven.

Unlike traditional IRR, the modified internal rate of return helps individuals to calculate project sensitivity since it measures the variation between the cost of capital and financing cost.

The major drawback of MIRR is that it requires people to multiple decisions concerning the cost of capital and financing rate.

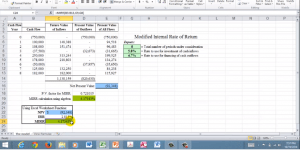

MIRR Calculation Example

Using a specimen company, Drink Incorporation, we can see how MIRR can be used to compare potential investments.

Drink Incorporation has plans to invest in Investment X and Investment Y, which will both run for 3 years (2013 to 2015). The cost of capital for X and Y is 12% and 15% respectively. Since the company does not have ready capital, it will incur 14% financing cost for Investment X and 18% for Investment Y. The cash flows for the 3 years are provided in the schedule below:

| Details | Investment X ($) | Investment Y ($) |

|---|---|---|

| 2012 | -2,000 | -1,200 |

| 2013 | -4,000 | -900 |

| 2014 | -6,000 | 3,000 |

| 2015 | -7,000 | 2,500 |

The generally acceptable MIRR function is given below.

MIRR= (FV of Positive Cash Flows / PV of Negative Cash Flows) * (1 / n) – 1

Step 1: Drink Inc. should calculate future value (FV) of the positive net inflows as follows (should be discounted at cost of capital):

a) Investment X: 6,000 * (1 + 12%) 1 + 7,000 = $13,720

b) Investment Y: 3,000* (1 + 15%) 1 + 2,500 = $5,950

Step 2: Calculate present value of negative net inflows (should be discounted at financing cost)

a) Investment X: -2,000 + (-4,000) / (1+14%) 1 = -$5,263

b) Investment Y: -1,200 + (-900) / (1+18%) 1 = -$1,780

Step 3: With these outcomes, MIRR for both projects would be:

a) Investment X: (13,720 / -5,263) (1/3) – 1 = 13.1%

b) Investment Y: (5,950 / -1,780) (1/3) – 1 = 11.4%

Step 4: Based on the MIRR calculated for both projects, Investment X should be implemented because it has a greater MIRR as compared to Investment Y.

Conclusion

MIRR is a comprehensive investment measurement method. It is widely used to assess projects with a mix of negative and positive cash flows.

It is better than IRR because it helps individuals in making concrete investment decisions. The outcomes generated are clear, which means people would not hesitate using it in real life. The application of this method can be done using four main steps as discussed above.

Individuals should compound positive cash flows, and then, discount all negative net cash inflows. However, despite MIRR attractiveness people view it as complex due to steps involved as well as multiple estimations that should be made.

FAQs on MIRR

What is the difference between IRR and MIRR?

MIRR can be used to assess projects with inconsistent cash flows while IRR cannot.

How do you calculate MIRR?

There are four steps involved in the calculation of MIRR, but the main ones include compounding positive cash flows and discounting negative cash flows.

What is the MIRR formula?

The general MIRR formula is shown below:

MIRR= [(FV of Positive Cash Flows / PV of Negative Cash Flows) * (1 / n) – 1]

What is the project’s MIRR?

A project MIRR is the rate at which cash flows generated by investment is reinvested.

What is the reinvestment rate in MIRR?

The reinvestment rate refers to the percentage of net cash inflows that should be absorbed by the project while the remaining portion of cash flow is invested elsewhere.