Cost accounting is both an art and a science that involves recording, classification, summarization and analysis of organizational costs. The end product of the cost accounting process should be of use to an organization’s management for making prudent decisions. As it is evident, the subject is made up of two words, ‘Cost’ and ‘Accounting’.

The expense that a particular unit in the production process of an entity incurs is referred to as cost. This means that always, an organization has to sacrifice something to produce a unit of a product.

Accounting, on the other hand, ensures that an organization’s financial, management and cost information makes sense to the stakeholders.

Therefore, cost accounting entails aspects such as products, processes, and project costs determination. Additionally, it ensures accurate recording of amounts in the financial statements. As a result, management of organizations can adequately plan and execute cost control measures.

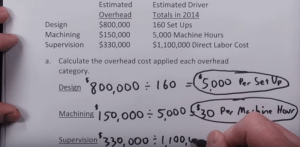

A case in point is the process of allocating manufacturing overhead costs within a business. The applications used include process, operations, and job order costing approaches.

Principles of Cost Accounting

The major principles of cost accounting would be outlined as follows:-

- Cause-Effect Relationship- This principle demands that each item of cost must have a relationship between its cost and effect determined.

- Cost should only be charged after it is incurred.

- Past and future costs should be as distinct as possible. This principle helps in ensuring that the true future results are not impacted or distorted.

- Cost accounts should always be free from abnormal costs as much as possible. This helps prevent the distortion of cost figures, which would otherwise have the impact of misleading management.

- While recording cost figures in the books of accounts, the double-entry principle should always be adhered to. This helps in lessening the possibility of mistakes and errors as much as possible.

Significance of Cost Accounting

The significance of cost accounting is as a result of its purposes and include cost control, cost computation and cost reduction. The significance of cost accounting is discussed below:

- Cost control – cost accounting is significant in helping management to define organizational costs as per the laid down budgetary constraints. This is vital in ensuring the efficient and effective use of an organization’s limited resources on projects.

- Cost computation – This is the major significance of cost accounting. It forms the basis upon which the rest of the cost accounting aspects are based.

- Cost Reduction – project and process costs in an organization are significantly reduced after computing and understanding the costs.

Types of Cost Accounting

There are various types of cost accounting as discussed below:

- Activity-based Cost Accounting – This type of cost accounting assigns costs of activities undertaken to the respective products or services.

- Marginal Cost Accounting – It is also called Cost-Volume-Profit Analysis. As the name suggests, it involves the relationship analysis of parameters including volume, costs, sales, expenses and profits among others.

- Lean Accounting – This type reiterates on pricing based on value and performance based on control.

- Standard cost Accounting – This is where ratios are used in the comparison of overheads used during production.

Types of Costs

In running an organization or business such at Top Paper Archives, costs form a major component of decision making. The subject costs are vast because they culminate across all the factors of production. The costs must, therefore, be measured in the process of doing business. This is necessary to help determine the relationship between the cost of input and the quantity produced. It is easy to quantify many costs, especially those that are observable. Because costs relate differently to output, they can be categorized differently as follows:

- Fixed and Variable Costs – While variable costs change with a change in output, Fixed costs are always constant.

- Direct and Indirect Costs – Direct costs have a direct relationship to output volume while indirect costs do not have such a relationship.

- Product and period Costs – Product costs are directly associated with output, hence used in the valuation of inventory while period costs do not have any form of relationship to production output.

- Other types of costs can be categorized as:- Controllable vs. uncontrollable, out of pocket vs., sunk costs, incremental vs. opportunity costs and imputed costs among many other categories.

Roles of a cost accountant

In a fully functioning organization, a cost accountant needs to be engaged. This personnel has several roles and responsibilities that would aid the proper functioning of an organization. A cost accountant should be a professional with the right qualifications and experience. Their roles vary from one organization to another, but they culminate around the following:

- Operational data collection from which analysis reports are formulated to help in the expenses and budgets forecast.

- Cost accountants should also undertake production, maintenance and inventory control data collection.

- They are also involved in the management and coordination of physical stock-taking exercises in an organization.

- Besides being involved at the end of month in data preparation exercises, cost accountants are key to the production costs data evaluation. Additionally, they undertake the appraisal of gains and losses experienced during a production cycle.

- Variances in organizational reports and data are also studied, reviewed and reconciled by the cost accountants. As a result, their participation in solutions identification and control gaps resource creation becomes prudent.

- Cost accountants also get involved in improvement strategy designs, creation and implementation. This includes their participation in ensuring best practices and processes in an entity.

Cost Accounting tasks are both theoretical and technical in nature. Several cost accounting homework help and accounting homework help websites are always available to help with problems on cost accounting however technical such problems may be.

You must be logged in to post a comment.